Optimizing profits in a medical practice requires a delicate balance between providing excellent patient care and ensuring financial stability. While patient care remains the top priority, overlooking revenue cycle management (RCM) can cost you serious money and impact your bottom line.

The good news: while many practices are not optimizing their financials due to inefficiencies in core operations, by tightening up these processes you can see a significant boost in revenue without major overhauls. Let’s explore nine key strategies to maximize your medical practice revenue and improve financial health.

1. Staff Right, Staff Smart: Optimizing Your Healthcare Workforce

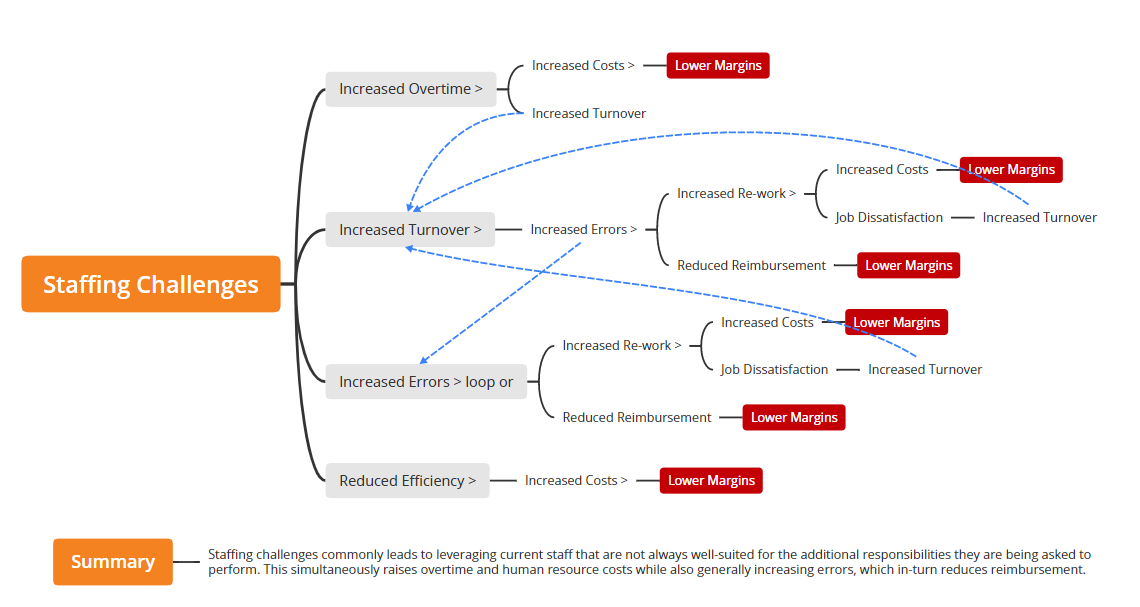

Staffing costs can eat up a significant portion of a medical practice’s budget – studies suggest it accounts for 30-60% of overhead [Sources: MGMA; HFMA]. Both understaffing and overstaffing can be detrimental and lead to loss of revenue and lower margins.

The Pitfalls of Understaffing a Medical Office:

- Increased Overtime: A skeleton crew often leads to staff working long hours, which raises fatigue and potential errors.

- High Turnover: Burned-out staff are more likely to leave, leading to constant recruitment and training costs.

- Increased Errors: Rushed staff working beyond capacity are prone to mistakes in coding, billing, and patient care.

- Reduced Efficiency: Understaffing creates a bottleneck effect, hindering patient flow and productivity.

Overstaffing Can Add More Problems than Just the Expense

Staff salaries and benefits are major expenses, and having more employees than needed directly translates to higher payroll costs, leaving less profit. Additionally, with too many staff members, inefficiency can creep in. This might involve redundant tasks or staff with not enough to do, leading to decreased productivity.

Adjust the Team for Work to Staff Ratio

Conduct a thorough staff workload analysis to determine the ideal number of team members needed for various roles. Look to MGMA for benchmarks and helpful articles on right sizing medical teams.

2. Capture Revenue at the Source: Prioritize Patient Collections

Many practices struggle to collect full payment from patients at the time of service. This includes patient estimations, co-pays, co-insurance, and deductibles collected before the visit.

Here’s how to improve collection rates:

- Implement Transparent Cost Estimates: Provide patients with upfront estimates for services, including potential out-of-pocket costs.

- Offer Multiple Payment Options: Make it easy for patients to pay by offering credit cards, debit cards, cash, or installment plans.

- Collect Co-Pays and Deductibles Upfront: Require co-pays and deductibles at the time of service whenever possible.

- Train Staff on Collection Techniques: Equip your staff with clear communication skills and protocols for collecting patient payments.

3. Eliminate Write-Offs: Manage Medical Fee Adjustments

Medical fee write-offs occur when a practice reduces the amount it charges a patient due to insurance denials, contractual adjustments, or patient inability to pay. While some write-offs are inevitable, excessive write-offs indicate a gap in your RCM process.

Here’s how to minimize write-offs:

- Track and Analyze Adjustments: Monitor the reasons behind write-offs to identify patterns and areas for improvement.

- Aggressively Appeal Denials: Train staff on proper appeal procedures to fight denials and recoup potential revenue.

- Negotiate with Insurance Companies: Regularly review and negotiate contracts with insurance providers to secure better reimbursement rates.

4. Optimize Your Fee Schedule: Invest in Accurate Billing

Your medical fee schedule outlines the charges for your services. An outdated or poorly designed fee schedule can lead to undercharging and lost revenue.

Here’s how to ensure your fee schedule is optimal:

- Maintain Up-to-Date Coding: Keep your fee schedule current with the latest medical coding standards to accurately reflect the services you provide.

- Benchmark Against Competitors: Research competitive pricing for similar services in your area to ensure you’re charging fair market rates.

- Review and Update Regularly: Schedule annual reviews to adjust your fee schedule based on inflation, changes in practice costs, and insurance reimbursement rates.

5. Fight for Fair Pay: Navigate Medical Payer Underpayments

Medical insurance companies sometimes underpay for services rendered. Practices need proactive measures to ensure they receive proper reimbursement.

- Understand Insurance Contracts: Thoroughly review and understand your contracts with insurance payers to avoid misunderstandings.

- Document Everything: Maintain meticulous records of services provided, diagnoses, and supporting documentation to strengthen your case in case of underpayments.

- Negotiate and Appeal: Don’t hesitate to negotiate with insurance companies and follow proper appeals procedures to secure fair reimbursement.

6. Bill Me Once, Bill Me Twice: Embrace Complete Billing

Under trained or overwhelmed staff can overlook proper billing practices. Incomplete or inaccurate billing leads to missed revenue opportunities.

Here’s how to ensure comprehensive billing:

- Invest in Staff Training: Provide staff with training on proper medical coding, billing procedures, and using your practice management software effectively.

- Utilize Technology: Consider implementing practice management software or working with an expert medical billing company that automates billing tasks and reduces human error.

- Double-Check and Follow Up: Establish a system of checks and balances

7. Don’t Leave Money on the Table: Pursue Denied Medical Claims

Kaufman-Hall reports that ⅔ of denied medical claims go unchallenged. Here’s why you shouldn’t ignore claim denials:

- The Odds are in Your Favor: Studies show that up to 50% of appealed claims are eventually paid by insurance companies [Source: AMA].

- Time is Money: Act quickly on denials. The longer you wait, the less likely you are to recover the lost revenue.

- Invest in Staff Training: Train your staff on proper appeals procedures and equip them with the knowledge to fight denials effectively.

- Consider Outsourcing: If you’re experiencing a high volume of denials, consider outsourcing to a medical billing specialist with expertise in navigating the appeals process.

8. Failing to Measure RCM KPIs: Why It’s Costing Your Practice Money

Imagine driving a car blindfolded. You might reach your destination eventually, but it would be a slow, inefficient, and potentially dangerous journey. The same principle applies to managing a medical practice’s revenue cycle.

Without measuring key performance indicators (KPIs), you’re essentially operating in the dark, missing opportunities to improve efficiency and maximize revenue.

What are RCM KPIs?

Think of RCM KPIs as your dashboard gauges. They provide critical insights into the health of your practice’s revenue cycle, highlighting areas that are functioning well and pinpointing bottlenecks that need attention.

Here are some key RCM KPIs to consider:

- Accounts Receivable (A/R) Days: This measures the average time it takes to collect patient payments after services are rendered. A high A/R indicates slow collections and potential cash flow issues.

- Medical Claim Denial Rate: This tracks the percentage of medical claims rejected by insurance companies. A high denial rate suggests issues with coding, documentation, or billing practices.

- Patient Collection Rate: This measures the percentage of total charges that are successfully collected from patients and insurance companies. A low collection rate indicates lost revenue.

- Clean Medical Claim Rate: This tracks the percentage of claims submitted to insurance companies that are processed without errors. A low clean claim rate suggests inefficiencies in billing and coding.

- Medical Fee Write-off Rate: This measures the percentage of charges that are ultimately not collected due to patient inability to pay, contractual adjustments, or other reasons. A high write-off rate signifies potential revenue loss.

Contact us and compare your practice KPIs to industry standards and find out which categories you can prioritize for the most profitable improvements right away.

What is the Benefit of Measuring Healthcare RCM KPIs?

Regularly monitoring these KPIs allows you to:

- Identify Problem Areas: KPIs reveal bottlenecks and inefficiencies in your revenue cycle. For example, a high A/R could indicate gaps in patient billing practices.

- Track Progress: By monitoring KPIs over time, you can assess the effectiveness of implemented improvements and measure progress towards financial goals.

- Benchmark Performance: Compare your practice’s KPIs against healthcare industry benchmarks to identify areas where you might be lagging behind competitors.

- Make Data-Driven Decisions: KPIs provide concrete data to support informed decisions about staffing, technology investments, and RCM process optimization.

Here’s a roadmap for incorporating RCM KPIs into your practice:

- Identify Relevant KPIs: Choose a set of KPIs that directly align with your practice’s goals and financial priorities. UnisLink can help with that.

- Establish Baseline Measurements: Gather historical data to establish a baseline for each chosen KPI.

- Set Measurable Targets: Define realistic yet ambitious targets for improvement in each KPI.

Track and Report Regularly: Schedule regular intervals (e.g., monthly, quarterly) to monitor your KPIs and generate data analytics reports. - Analyze and Take Action: Analyze the data to identify trends and areas for improvement. Take corrective actions to address problem areas and optimize your RCM processes.

Measuring RCM KPIs is not just about collecting data; it’s about unlocking valuable insights that can transform your practice’s financial performance. By integrating KPIs into your practice management strategy, you can gain the clarity and control needed to streamline revenue collection, minimize losses, and achieve long-term financial success.

9. Look Beyond Fee-for-Service: Explore Additional Revenue Streams

The traditional fee-for-service model isn’t the only way to generate revenue. Here are some additional options to consider:

- Outreach for Patient Recall and Regular Preventative Care Services: Promote preventative care services like vaccinations and annual checkups to generate recurring revenue. Ensure all patients are receiving reminders and phone calls about their maintenance well-exams.

- Telehealth Services: Consider offering telehealth consultations for patients who cannot visit the office in person.

- Cosmetic Procedures: Certain practices may offer cosmetic procedures, important screenings, and other optional therapeutic services that are not covered by insurance, creating a new revenue stream.

- Ancillaries: Add complimentary ancillaries like lab, x-ray or pharmacy to your practice.

- Chronic Care Management and Remote Patient Monitoring: Consider adding chronic care management and remote patient monitoring to enhance revenue with existing patients.

Don’t Leave Healthcare Money on Someone Else’s Table

By implementing these nine strategies, medical practices can significantly improve their revenue cycle management and boost their bottom line. Remember, many of these improvements are achieved through attention to detail, staff training, and utilizing technology effectively. By focusing on these areas, you can free up resources to reinvest in patient care and ensure the long-term success of your practice.

Partner with UnisLink and Learn How to Improve Your Revenue Immediately

The experienced team at UnisLink will provide a free revenue opportunity assessment to identify which areas of your practice are ripe for improvement. When these priorities are discovered and acted on, you can turn your problem areas into more cash flow immediately.

Contact us today for more information on this topic and your free consultation.